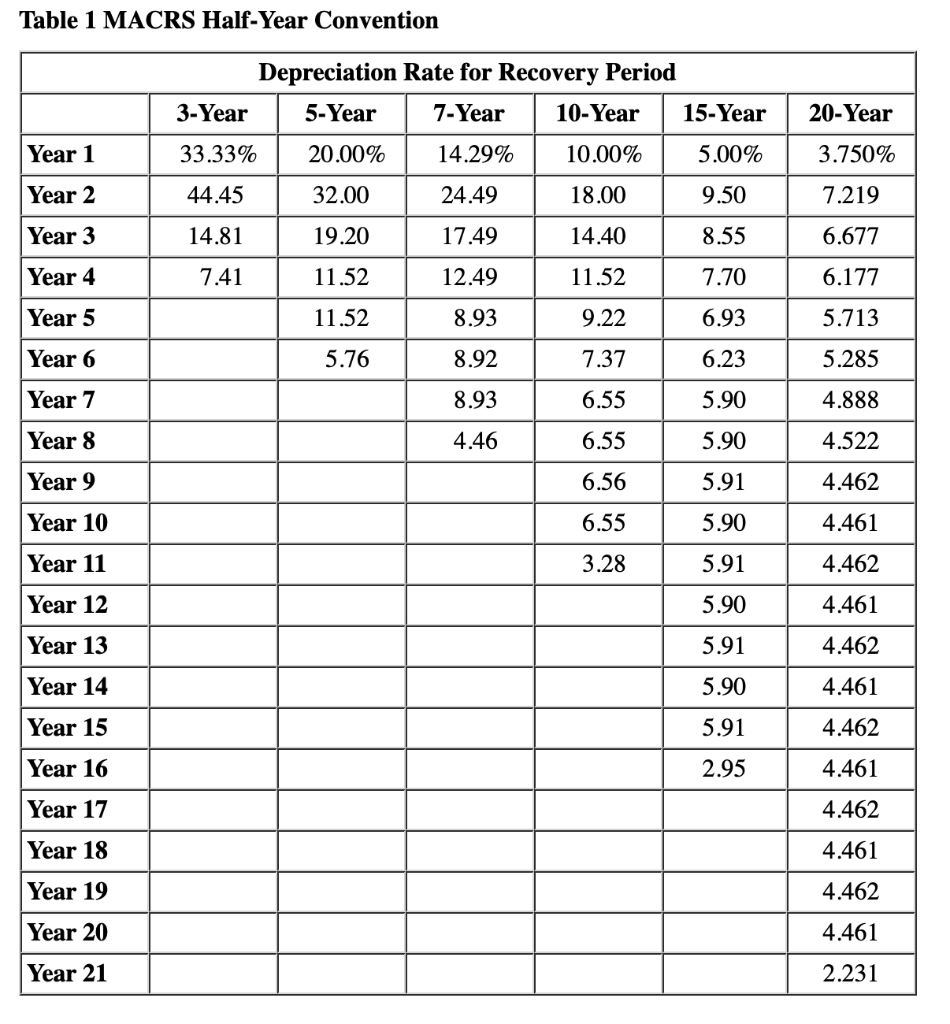

Macrs Depreciation Schedule Irs . Which depreciation system \(gds or ads\) applies?. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. This means that the business can take larger tax deductions in.

from www.chegg.com

Which depreciation system \(gds or ads\) applies?. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. This means that the business can take larger tax deductions in. the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by.

A. Using MACRS, what is Javier’s depreciation

Macrs Depreciation Schedule Irs the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. This means that the business can take larger tax deductions in. Which depreciation system \(gds or ads\) applies?. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other.

From awesomehome.co

Macrs Depreciation Table 2017 39 Year Awesome Home Macrs Depreciation Schedule Irs the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. Which depreciation system \(gds or ads\) applies?. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. the macrs depreciation method allows greater accelerated depreciation over the life of the. Macrs Depreciation Schedule Irs.

From youngandtheinvested.com

MACRS Depreciation, Table & Calculator The Complete Guide Macrs Depreciation Schedule Irs This means that the business can take larger tax deductions in. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. we’ll cover its use, key concepts and terms, and the important. Macrs Depreciation Schedule Irs.

From www.asset.accountant

What is MACRS Depreciation? Macrs Depreciation Schedule Irs the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. we’ll cover its use, key concepts and terms, and. Macrs Depreciation Schedule Irs.

From fitsmallbusiness.com

MACRS Depreciation Tables & How to Calculate Macrs Depreciation Schedule Irs Which depreciation system \(gds or ads\) applies?. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. This means that the business can take larger tax deductions in. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. the. Macrs Depreciation Schedule Irs.

From awesomehome.co

Irs Depreciation Tables In Excel Awesome Home Macrs Depreciation Schedule Irs Which depreciation system \(gds or ads\) applies?. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. This means that the business can take larger tax deductions in. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. the marcs depreciation calculator. Macrs Depreciation Schedule Irs.

From fitsmallbusiness.com

MACRS Depreciation Tables & How to Calculate Macrs Depreciation Schedule Irs the macrs depreciation method allows greater accelerated depreciation over the life of the asset. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by. This means that the business can take larger tax. Macrs Depreciation Schedule Irs.

From youngandtheinvested.com

MACRS Depreciation Table Guidance, Calculator + More Macrs Depreciation Schedule Irs the macrs depreciation method allows greater accelerated depreciation over the life of the asset. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by. the modified accelerated cost recovery system (macrs) is. Macrs Depreciation Schedule Irs.

From brokeasshome.com

Irs Depreciation Tables 2018 Macrs Depreciation Schedule Irs Which depreciation system \(gds or ads\) applies?. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. the modified accelerated cost recovery system (macrs) is the current method of accelerated. Macrs Depreciation Schedule Irs.

From www.youtube.com

IRS MACRS GDS ADS Depreciation System Which Table Should You Use Macrs Depreciation Schedule Irs Which depreciation system \(gds or ads\) applies?. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. This means that the business can take larger tax deductions in. the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by. the. Macrs Depreciation Schedule Irs.

From alquilercastilloshinchables.info

8 Pics Macrs Depreciation Table 2017 39 Year And View Alqu Blog Macrs Depreciation Schedule Irs we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. This means that the business can take larger tax deductions. Macrs Depreciation Schedule Irs.

From elchoroukhost.net

Macrs Depreciation Table 2018 Elcho Table Macrs Depreciation Schedule Irs the macrs depreciation method allows greater accelerated depreciation over the life of the asset. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. This means that the business can take larger tax deductions in. the marcs depreciation calculator creates a depreciation schedule showing the depreciation. Macrs Depreciation Schedule Irs.

From www.fastcapital360.com

How to Calculate Depreciation Using MACRS (Plus Tables) Macrs Depreciation Schedule Irs the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. This means that the business can take larger tax deductions in. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. Which depreciation system \(gds or ads\) applies?. the modified accelerated cost recovery system. Macrs Depreciation Schedule Irs.

From www.taxdefensenetwork.com

Cómo completar el formulario 4562 del IRS Macrs Depreciation Schedule Irs the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. This means that the business can take larger tax deductions in. the macrs depreciation method allows greater accelerated depreciation over the life of the. Macrs Depreciation Schedule Irs.

From www.exceldemy.com

How to Use MACRS Depreciation Formula in Excel (8 Methods) Macrs Depreciation Schedule Irs the macrs depreciation method allows greater accelerated depreciation over the life of the asset. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. Which depreciation system \(gds or ads\) applies?. This means that the business can take larger tax deductions in. we’ll cover its use, key concepts and terms, and. Macrs Depreciation Schedule Irs.

From brokeasshome.com

Macrs Depreciation Table 7 Year Property Macrs Depreciation Schedule Irs the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. This means that the business can take larger tax deductions in. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. Which depreciation system \(gds or ads\) applies?. the modified accelerated cost. Macrs Depreciation Schedule Irs.

From elchoroukhost.net

Irs Macrs Depreciation Table Excel Elcho Table Macrs Depreciation Schedule Irs we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. Which depreciation system \(gds or ads\) applies?. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial. Macrs Depreciation Schedule Irs.

From dxozijynq.blob.core.windows.net

Equipment Depreciation Life Macrs at Stephen Connelly blog Macrs Depreciation Schedule Irs the modified accelerated cost recovery system (macrs) is the current method of accelerated asset depreciation required by. the modified accelerated cost recovery system (macrs) is a depreciation method used for tax purposes and is more beneficial than other. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. the macrs. Macrs Depreciation Schedule Irs.

From www.youtube.com

How to Implement MACRS Depreciation Method + Example YouTube Macrs Depreciation Schedule Irs Which depreciation system \(gds or ads\) applies?. the macrs depreciation method allows greater accelerated depreciation over the life of the asset. the marcs depreciation calculator creates a depreciation schedule showing the depreciation percentage rate, the depreciation expense. we’ll cover its use, key concepts and terms, and the important components of a macrs depreciation table. the modified. Macrs Depreciation Schedule Irs.